How will new Social Health Insurance Fund impact Kenyans?

In a significant move, Kenya has ushered in a new era of healthcare with the recent signing into law of four transformative pieces of legislation in 2023 – the Social Health Insurance Act, Primary Health Care Act, Digital Health Act, and Facility Improvement Financing Act. These laws mark a turning point by extending public healthcare coverage to all Kenyans and long-term residents while fundamentally restructuring healthcare financing and administration.

The centre-piece of these reforms is the establishment of the Social Health Insurance Fund (SHIF), which will replace the National Health Insurance Fund (NHIF) but will, like its predecessor, be primarily funded by employee contributions. This fund aims to provide universal public healthcare coverage and will be complemented by the Primary Healthcare Fund and the Emergency, Chronic, and Critical Illness Fund, both primarily funded by government allocations. To oversee the efficient administration of public healthcare benefits and funding, a new Health Insurance Authority will be put in place.

The NHIF, which was funded by employee contributions from only formally-contracted employees, will be phased out by October 2024, with its funds transferred to the newly formed SHIF. These changes mark a departure from the previous system, where public healthcare coverage was mandatory only for formal employees.

Who bears the burden of new SHIF contributions?

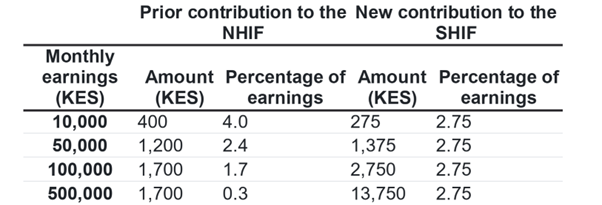

One of the key changes is the introduction of a flat 2.75% employee contribution to the SHIF, calculated on earnings for formal employment. This replaces the previous NHIF contribution structure, which, though also wage-related, was fixed and varied based on specific earning bands.

This means that most earners, though not all, will be paying more to the SHIF than they were for the NHIF. The table below shows how much different wage earners can expect to lose as part of their monthly contribution to SHIF and how that compares to what was previously paid to NHIF.

Notably, individuals and households without formal earned income, constituting over 80% of workers engaged in informal employment and subsistence agriculture, will now be forced to pay into the communal health insurance fund. An annual SHIF contribution based on household income, subject to means testing, will be used to calculate how much these informal earners must contribute.

Foreign visitors in Kenya for less than 12 months are now required to possess valid travel health insurance, aligning with the broader efforts to enhance health coverage.

Employer implications and the road ahead

For employers, this overhaul introduces increased employee costs for state healthcare. While past drafts had suggested employer matching of employee healthcare contributions, the final legislation does not explicitly mandate this, although it does allude to the possibility of employer contributions.

Historically, the perceived inefficiency of the NHIF drove many private employers into providing a private health insurance package for their employees. It is unclear right now whether the SHIF will be a more efficiently run machine and therefore we cannot predict whether private employers will still feel the need to make their own plans for the healthcare of employees.

However, what may well be possible, in light of this radical restructuring being quite an ambitious project, is that the shift between NHIF and SHIF may disrupt some services as all issues are ironed out.

This may make private health insurance more attractive in the short term.

Ensuring compliance and curbing corruption

With the establishment of the Social Health Authority (SHA) to replace the NHIF, compliance seems to have become a central focus. Eligible individuals must provide proof of compliance (read as ‘proof of meeting required payments’) to access public services, a provision designed to streamline and regulate the healthcare system efficiently.

The legislation emphasizes inclusivity, allowing all non-Kenyans residing in the country for over 12 months to be eligible for SHIF membership. Those planning to stay for less than a year are required to have travel health insurance. To deter corruption, severe penalties, including imprisonment for five years or a fine of Sh1 million, or both, are stipulated for those suspected of defrauding the health insurance scheme through false statements.

As the defunct NHIF transfers its cash balances to the SHIF, Kenya stands on the cusp of a transformative healthcare journey. The effectiveness of these reforms will be contingent on seamless implementation, widespread awareness, and adaptability in the face of the significant shifts in the national healthcare landscape.

TAGS